- What is the R&D tax credit?

The United States government promotes and incentivizes business innovation by allowing tax credits for research-related expenditure. Known as Research and Development (R&D) tax credit, it is a highly underrated tax incentive that can be claimed by a business of any size and is not restricted to large corporations or research labs. - How is the R&D tax credit computed? How much tax savings can I potentially get?

There are two general methods: the Regular Credit (RC) method and the Alternative Simplified Credit (ASC) method. Both methodologies are included in the IRS Form 6765 Credit for Increasing Research Activities. The taxpayer is permitted to elect either of the two methods when preparing to file the return. However, since each method has distinct advantages and disadvantages, it is important to understand both – mainly because the elected method cannot be changed on an amended return.

The R&D tax credit can range between 6%-14% of the company’s current year qualified research expenses. - Which industries are eligible for the R&D tax credit?

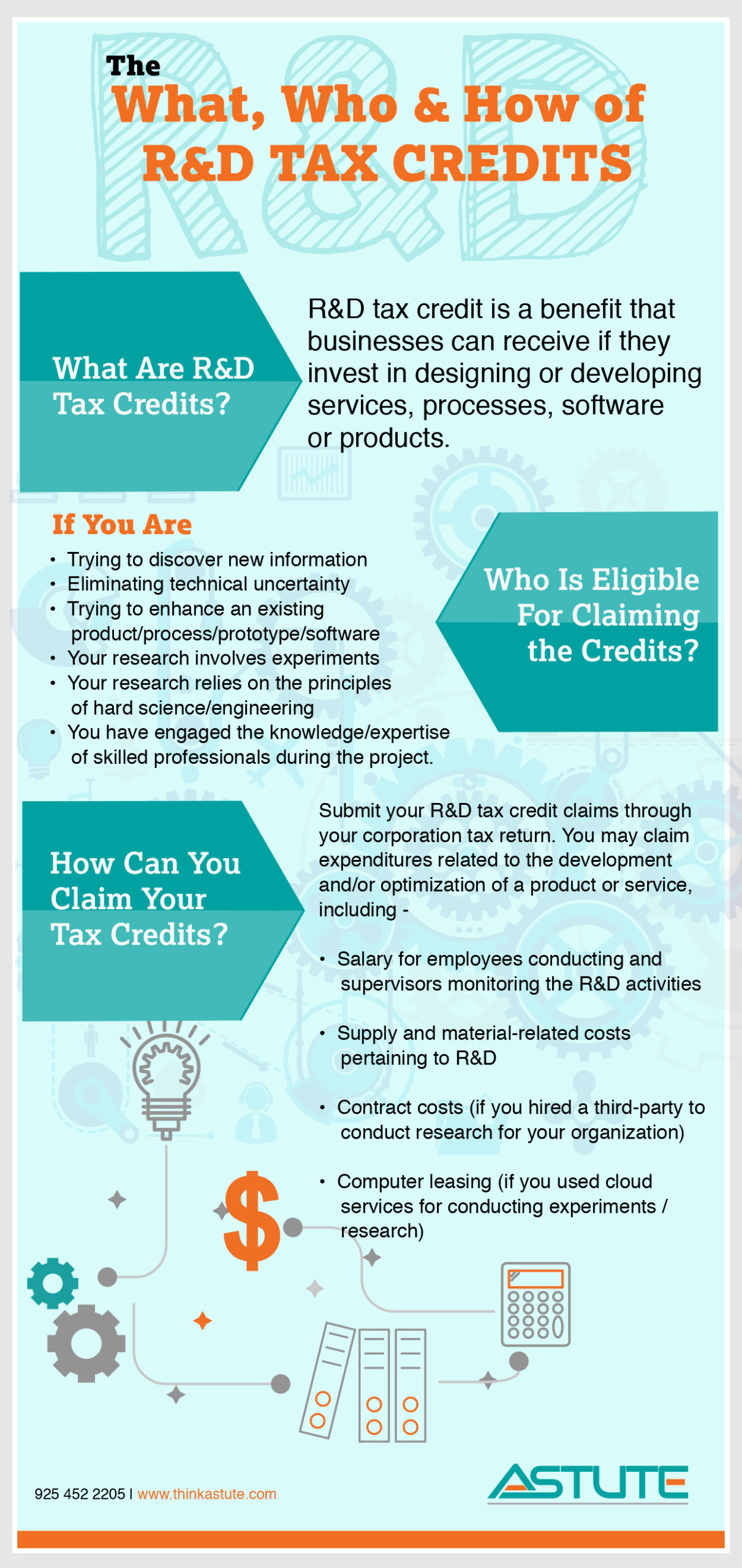

If your company has invested in designing or developing a process, service, software, or product in science or technology, you could be eligible for the R&D tax credit. Please refer to this infographic to determine your company’s eligibility. - What research activities qualify for the R&D tax credit?

Companies that are most likely to qualify will have research activities focused on:

- Developing a new or enhancing product/process/prototype/software

- Eliminating technical uncertainty

- Principles of hard science/engineering

- Research for a qualified purpose that involves experiments

Research activities, irrespective of their success, must engage a scientific process to improve the business either through processes, products, or software.

- What are the benefits of the R&D tax credit?

Being committed to innovation is critical if you want to gain a solid edge over your competitors. Other benefits include:

- Reduction in federal & state income tax liability

- Immediate cash flow

- Tax credit carried forward up to 20 years.

- Unclaimed credit for open tax years, generally the last 3–4 years.

- Why do most businesses neglect to file the R&D tax credit?

This is normally due to the lack of sufficient information, or they believe they do not have the right type of business. The PATH Act of 2015 opened up the R&D tax credit’s rewards to many SMEs and Startups.

- What documentation do I need to submit in order to qualify for the tax incentive with the IRS?

A proper mechanism should be put in place to track and document designs, processes, objectives, action steps, discussion points, failures, and successes in real-time.The following tips will help you improve your the R&D tax credit documentation:

- Retain records of lab reports, project lists, project notes, logs, PO’s internal emails, patent claim, and experiment descriptions

- Use an online timesheet to track your project’s timeline – this will document the R&D related wages.

- Keep contracts, invoices, and 1099 forms on-file to demonstrate your IP rights, especially if you subcontract the R&D work

Our earlier blog takes a more in-depth look at the documentation.

- What expenses qualify for the R&D tax credit?

Qualified research expenses generally include:- Employee and Supervisor wages (only for the % of time spent on the R&D activities)

- Contractor costs if you hired a third-party contractor to perform research

- Supply and material costs incurred in the R&D activities

- Computer leasing for Cloud services used to conduct experiments/research

- What if I missed claiming the R&D tax credit in the past?

Can I claim it now? For how many years can I go back and claim?Normally, you can get unclaimed credit for open tax years, specifically the last 3-4 years. If your credit exceeds the amount you paid in income tax(es), you can carry-forward unused credit for up to 20 years.- Can a Startup without a taxable Income take advantage of the R&D Tax Credit?

Yes, you can claim the R&D Tax credit as long as you have incurred qualified research expenses in the taxable year. Any unused credit can be carried forward up to 20 years or used earlier if it becomes profitable and offsets the unused credits against the tax liabilities in those years.Startups and small businesses can qualify for up to $1.25 million (or $250,000 each year for up to five years) of the federal R&D Tax credit to offset the FICA portion of their annual payroll taxes.To qualify, Startups must:- have less than $5 million of revenue in the year that the credit is claimed and,

- not have had any revenue before the last five years.

To learn more, please contact Astute. We have been providing the R&D tax credit services to many businesses year-after-year, saving them millions of dollars.

Our research indicates that most small businesses are unaware of an R&D tax credit. They don’t understand how it can help them earn up to 13.5 cents for every qualified dollar!

Due to a lack of information surrounding this unique tax credit, it is easy to assume that the credit is only meant for research labs or large corporations. This is a myth – thanks to the PATH Act of 2015, a wide variety of SMEs and start-ups can also reap the benefits of this tax credit if they have invested in designing or developing processes, services, software, or products in science or technology. For example, a furniture manufacturer might not be traditionally viewed as a research-based company, and yet the unique design process they use to manufacture their products makes them qualified for the R&D tax credit. It is also important to be aware that your company’s investment in R&D activities do not have to be successful – the effort is rewarded irrespective of the outcome!

To find out if your activities are eligible for the R&D tax credit, please read our earlier blog post right here.

The government is ready to provide billions of dollars in R&D tax credit – both at the federal and state level (yes, 40 out of 50 states offer R&D tax credits!). Yet, a substantial amount of this funding remains untapped year-after-year due to inaction from companies. Businesses from all industry sectors that invest in some sort of innovation can enjoy R&D tax credit. For example, let’s take a look at how manufacturing companies might not realize the numerous ways in which they may qualify for the R&D tax credit. If they have invested in any of the following activities, they could be eligible for a substantial R&D tax credit –

- Introducing new technologies that improve the manufacturing process (includes specification/design of prototypes + pilot models)

- Designing new algorithms or software architecture

- Developing new capabilities and/or functional enhancements for existing applications

- Creating software in which technological challenges pertaining to scale and complexity are present

- Developing software applications for either internal use or to interact with customers/ vendors

- Developing new/improved processes pertaining to quality assurance testing

- Developing prototypes using CAD / computer-aided manufacturing processes

- Developing automated technology/robotics

And many more…

Similarly, companies across other industries may be unaware of the variety of activities they are already investing in that are eligible for the R&D tax credit. Lack of information causes many business owners to lose a huge tax saving, which is so critical during these trying times!

R&D tax credit offers a variety of benefits, including –

- Reduced federal & state income tax liability

- Improved cash flow

- Unclaimed credit for open tax years generally lasts three to four years.

- Ability to carry credit ahead for up to 20 years

To qualify for the R&D tax credit, businesses must ensure research activities meet the following four-part test –

- The research must lend itself to the development of new or improved products or processes

- The research must engage the fundamental principles of science and engineering

- The research must be conducted with the intention to eliminate technological uncertainties

- Lastly, the research must involve experiments

Additionally, documentation like lab reports, project lists, project logs, internal emails, patent claims, experiment descriptions, online timesheets, contracts, invoices, form 1099 is required to demonstrate research and qualified expenses, such as –

- Salary for employees conducting and supervisors monitoring R&D activities, only for the percentage of time spent on eligible activities

- Cost of supplies and materials related to R&D activities, not including general office supplies and depreciable assets

- Payments issued to US-based contractors who are a part of eligible R&D activities/research

The tax filing deadline is approaching. It is time for businesses (across all industries!) to get R&D Tax Credit paperwork ready literally now. Do not let uncertainty regarding how R&D tax credits are supposed to be calculated prevent you from claiming all the funds you have rightful access to! Astute has helped many businesses across all major industries claim the R&D tax credit and save millions in tax dollars. We carefully identify all of your company’s qualified activities, calculate what your tax credit benefit will look like, and put together compelling documentation to validate all of your claims. Enjoy federal and state income tax deductions from an R&D tax credit to improve your cash flow during these challenging times. For more information, please contact us right here.

If you or your company invests in designing and development of services, processes, software or products, you may be eligible for R&D Tax Credit benefit. Not sure about your eligibility for 2019 tax season? Check out this easy-to-use infographic that helps you identify eligibility guidelines for R&D tax benefits.

Don’t forget to give us credit at: Click it.

Did you know you could earn up to 13.5 cents of Research & Development (R&D) tax credit for every qualified dollar?

If you answered no, you’re not alone. Most companies have either never heard of R&D tax credits, or if they are aware of it, they haven’t filed any claim so far because they assume it is only meant for large corporations or research labs. In reality, thanks to the Protecting Americans from Tax Hikes Act (the PATH Act) of 2015, small companies and start-ups can also reap this tax advantage in their annual tax returns.

We’ve put together a handy guide for you to understand the in’s and out’s of R&D tax credits fully. Let’s take a closer look at what they are and how can they help you save taxes!

What Are Research & Development (R&D) Tax Credits?

R&D tax credit is a benefit that businesses can receive if they invest in designing or developing services, processes, software or products in science or technology. In essence, R&D tax credit is the government’s way of rewarding businesses for investing in innovation.

Has The R&D Tax Scheme Evolved Over The Years?

R&D tax is an initiative that began as a temporary scheme back in 1981. However, in 2015, the PATH Act made the R&D tax credit scheme permanent. Additionally, it included modifications that were appealing to SMEs and also opened up the scheme to start-ups. Congress has eliminated the Alternative Minimum Tax (AMT) bar – this enables businesses to enjoy the R&D tax scheme even more. The hope is that the American economy will become stronger as more businesses invest in increased innovation.

Who Is Eligible To Claim R&D Tax Credits?

As long as your business is investing in research and development activities that help innovation in science or technology, it doesn’t matter what industry sector you belong to – software, biotech/pharma, manufacturing, engineering, food, life sciences, construction, architecture, hospitals, food processing, research organizations, universities, financial services, wineries, warehouse services – the spectrum is quite wide! Even SMEs that sub-contract R&D work are often entitled to claim R&D tax credits.

Why Do Many Businesses Fail To Claim R&D Tax Credits?

Many businesses, especially small, fail to understand the importance of R&D tax credits and do not claim its benefits because:

- The fine print is long and can seem daunting to process

- Writing technical narrative to back claims can be challenging

- An accountant with expertise in R&D is usually required

- Lack of awareness surrounding the Act – most companies assume research has to be successful to claim credits but that’s not true. You do not have to introduce something that’s a major breakthrough. Effort gets rewarded, even without the outcome.

- Failure to realize there is a long list of activities that qualify for this credit, including processes to make a product greener, cleaner, faster, cheaper, automated.

- Lack of awareness that R&D tax claims can date back for 3 accounting years for expenditures that qualify (i.e. retrospective claims)

- Misconception that an in-house research lab is needed to qualify

Quite often start-ups, in particular, don’t realize they might qualify for R&D tax credit even if they don’t produce any profit / taxable income. IF they are considered a qualified small business (QSB), they are eligible to claim a special R&D payroll tax credit that offsets employer FICA taxes with the R&D credit for an annual savings of up to $250,000.

What Are The Eligibility Requirements for R&D Tax Credits?

- Are you trying to discover new information?

- Are you eliminating technical uncertainty?

- Are you trying to enhance an existing product/process/prototype/software?

- Does your research involve experiments?

- Does your research rely on the principles of hard science / engineering and have a qualified purpose?

- Have you engaged the knowledge/expertise of skilled professionals during the project?

What Can Businesses Claim Under the R&D Tax Relief Scheme?

Businesses can claim between 6-14% of R&D expenditure. The exact percentage varies depending on the state they operate in.

How Can You Claim R&D Tax Credits?

You must submit your R&D tax credit claims through your corporation tax return, supporting material may be required for IRS audit. You may claim expenditures related to the development and/or optimization of a product or service, including –

- Salary for employees conducting and supervisors monitoring the R&D activities (only the percentage of time spent on R&D activity, specifically)

- Supply and material-related costs pertaining to R&D (includes prototypes & specialized lab equipment, but NOT general office supplies and depreciable assets)

- Contract costs (if you hired a third-party to conduct research for your organization)

- Computer leasing (if you used cloud services for conducting experiments / research)

Sufficient supportive evidence is imperative for each of your claims – failures, successes / results, designs, meetings, discussion points, actions taken, objectives, etc. should all be tracked in real-time.

What Are Some Tips To Better Document R&D Tax Claims?

R&D tax credit claims are submitted as part of your tax return through form 6765 and 3800. The IRS might interview your technical / financial staff to clarify some points. A tax officer familiar with your particular state’s R&D tax laws will prove very handy in this overall process. Proper documentation and clear understanding of the process will prove imperative in filing your claim – the following best practices will help:

- Demonstrate your R&D activities with records (i.e. lab reports, project lists, project notes, logs, internal emails, patent claims, experiment descriptions, etc.)

- Track your project’s time with an online timesheet – this will document wages pertaining to R&D working hours in a clear manner

- Have contract agreements, invoices and 1099 forms on file, especially if you are subcontracting R&D work – these papers will point to your intellectual property rights

R&D tax credit claim is submitted as part of the tax returns through forms 6765 and

3800. The IRS might interview your technical/financial staff to clarify some points. A tax officer familiar with your particular state’s R&D tax laws will prove very handy in this overall process. Proper documentation and clear understanding of the process can help you file the claim.

Need further advice? Astute has helped many start-ups, pre-IPO companies and global Fortune 1000 companies in claiming substantial R&D tax credits successfully. To find out more, contact us right here.

- 1

- 2