Are you getting the appropriate R&D tax credit for your business?

What is Research & Development Tax Credit?

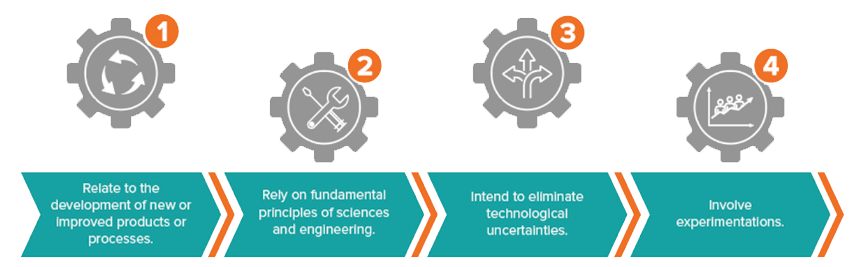

Research & Development tax credit is an incentive that rewards taxpayers for conducting research in the United States. Its goal is to promote and incentivize innovation by allowing tax credits for their research expenditures. It is for businesses of all sizes, not just for research labs and larger corporations.

Substantiating research activities, documenting research expenses, and computing research tax credits in a way that meets the stringent audit requirements of the IRS and state tax authorities isn’t easy. As a result, we find many taxpayers don’t receive the R&D tax credit they deserve.

RESOURCES

- Unlocks a hidden vault – instant injection of cash flow.

- Unclaimed credit for open tax years, typically last 3 to 4 yrs.

- Reduced effective tax rate – lowers Federal & State income tax liabilities in current and future years.

- Huge payroll savings, as salaries of those working on qualified activities are paid via the tax credit.

- Tax credit carried forward up to 20 years.

- Permanent tax savings.

- Increased ROI.

- Salaries of employees who either perform or supervise those conducting the research.

- Contractors hired for research: Limited to 65%, whether the process was successful or not.

- Associated cost of supplies used for research.

- Computer/Equipment lease and other rentals.

| Semiconductor | Pharmaceutical and Biotechnology |

| Food and Beverage | Medical Devices and Instrumentation |

| Wineries and Vineyards | Manufacturing and Consumer Products |

| Telecommunications | Architecture, Engineering & Construction |

| Energy and Environmental Services | Agriculture |

| Automotive | Aerospace and Defense |

| Clean Technology | Entertainment |

YES! A valuable perk for Startups that are in bootstrapped situations - R&D tax credits can help take the sting out of your losses.

The tax code has has been reversed to allow non-profitable businesses that pay payroll taxes, to offset up to $250k annually. The following conditions should be met:

- The business has < 5 years of gross receipts

- Current tax year gross receipts < $5M

- The business is not a tax-exempt organization

Technical

Accounting

Find out about the latest strategies and best practices for your business.

Outsourced/

Fractional CFO

Discover the strategies you can use to optimize your new business.

Royalty/Licensing

Audit

Discover the benefits of this compliance audit today.

Let's Talk!

Learn how Research & Development Tax Credit can save you money!

Astute’s team of professionals brought a wealth of experience into the R&D Tax Credit process and were very open and responsive to all our queries. They continuously exceed our expectations, and we are proud to recommend them for all R&D tax credit services. Astute is much more than an accounting firm; it’s a relationship.