The Employee Retention Credit (ERTC) was authorized under the CARES Act with the objective to encourage businesses to keep employees on the payroll.

ERTC has an incredible value for employers to get more cash out of 2020 and 2021. By taking advantage of this program, they can receive a tax credit for retaining and developing their employees even in tough times.

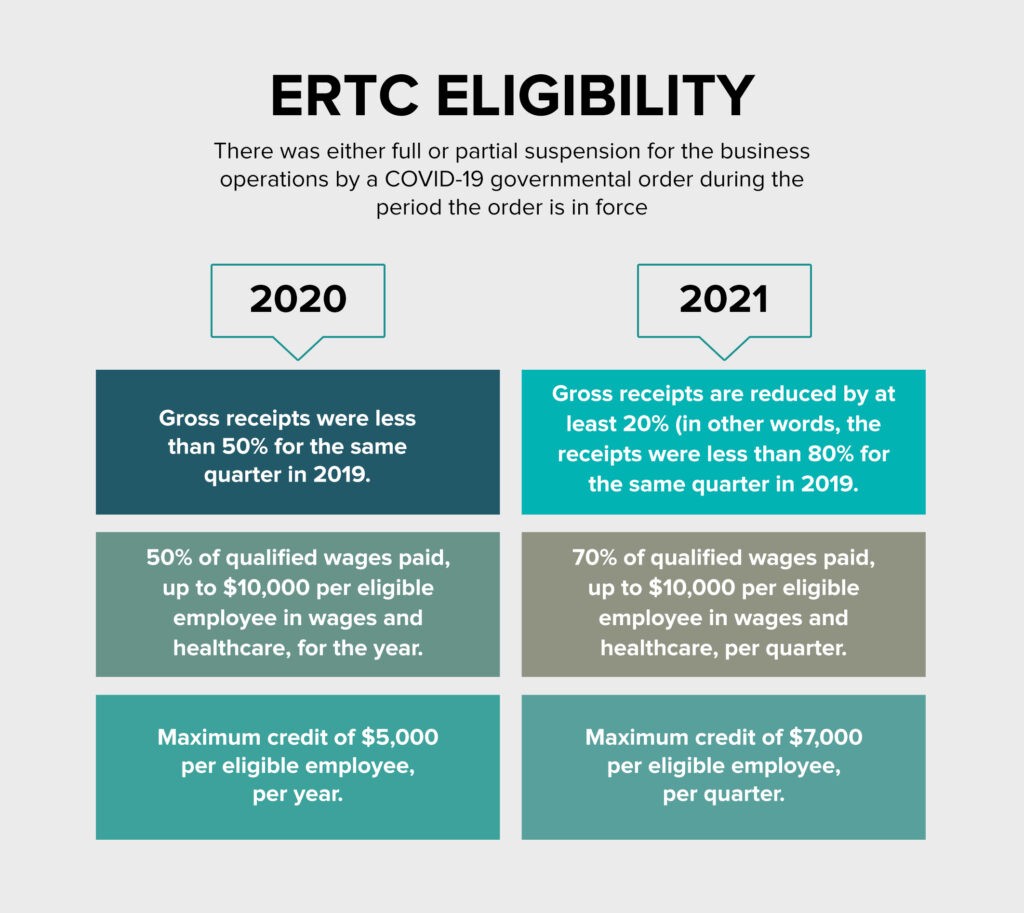

The ERTC is a refundable tax credit of up to $5,000 per employee per quarter for 2020; the credit for 2021 can be up to $7,000 per employee per quarter for 2021. The maximum credit can go upto $26,000 per employee.

Eligibility Criteria are Slightly Different for 2020 and 2021.

The two most critical factors to determine eligibility are:

- That a business had been fully or partially suspended or compelled to reduce business hours due to the Government order.

- That an employer has had a significant decline in gross receipts.

RESOURCES

The only way to claim the ERTC now is by filing payroll taxes retroactively and amending the relevant tax forms. This requires diligence and utmost professional care to ascertain eligibility and maximize the benefit.

To unlock the possibility of availing this benefit.

Astute’s team of professionals brought a wealth of experience into the R&D Tax Credit process and were very open and responsive to all our queries. They continuously exceed our expectations, and we are proud to recommend them for all R&D tax credit services. Astute is much more than an accounting firm; it’s a relationship.