The newly amended rules issued by the Financial Accounting Standards Board (FASB) for revenue standard ASC 606: Revenue from Contract with Customers, significantly impacted the revenue recognition practices for most industries. This amendment will replace ASC 605: Revenue Recognition and provides industry specific guidance. The implementation of ASC 606 has both, financial as well as operational reporting impacts for all entities executing contracts with their customers.

The International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB) (collectively, the Boards) respectively have issued largely converged new revenue standards: IFRS 15 Revenue from Contracts with Customers and Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers. These new revenue standards supersede virtually all legacy revenue recognition requirements in IFRS and US GAAP, respectively. ASC 606 affects all entities that have adopted GAAP in the United States and have entered into contracts with customers to transfer good, services and non-financial assets. Revenues from Leases, Loans, Investments, Insurance Contracts and Certain non-monetary exchanges are not affected by ASC 606.

THE REVISED EFFECTIVE DATES FOR THE IMPLEMENTATION OF NEW GUIDANCE ARE:

- Public Entities - For annual reporting periods beginning on or after December 15, 2017, and related interim periods.

- Nonpublic/ Private Entities - For annual reporting periods beginning on or after December 15, 2018, and related interim periods beginning after December 15, 2019.

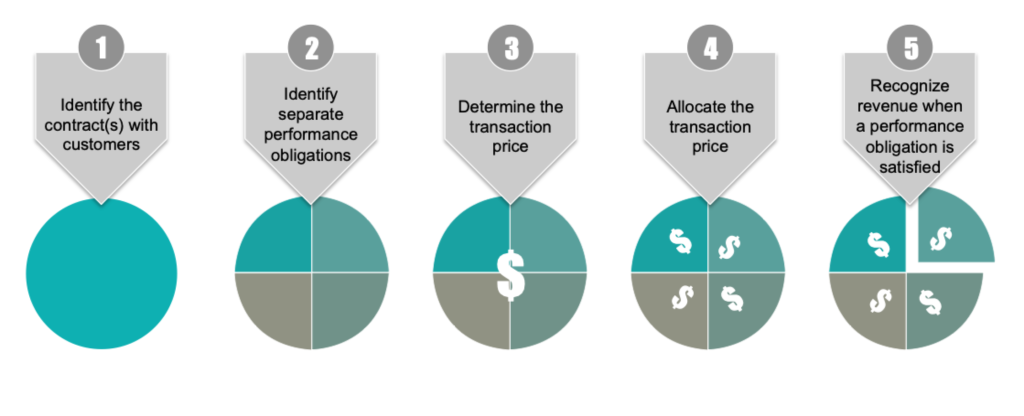

Under the revised ASC 606 standards, the new revenue standard has introduced a five-step model to recognize revenue. Both public and private companies need to re-evaluate their existing company contracts based on this model. It will help them to identify lost revenue and record it correctly in the company financials.

IT WILL HELP ANSWER TWO VERY IMPORTANT QUESTIONS:

- When to recognize revenue?

- How much to recognize as revenue?

Moving away from the legacy reward-based revenue recognition model to the new control-based standards, companies also require training and educating users about the changes they can expect in company’s financial statement.

Start by downloading this roadmap to ensure your company understands the changes to GAAP and determine how you will adopt the new guidance.

The Revenue Recognition changes are broad, and they impact all industries. These new standards go beyond just an accounting change: major business decisions, growth strategies, key performance matrix, sales compensation, tax planning/payments, processes, policies, controls and the list goes on.

IS YOUR BUSINESS READY FOR THIS CHANGE?

- Implementation Plan

- Transition Method

- Communication about the impact to internal shareholders

- Processes and controls

Let's Talk!

Contact Astute’s Revenue Recognition Experts Today!

Their excellent Technical Accounting and Audit knowledge helped us clean up some of the major areas of financial statements and assisted us in getting prepared for the audit.