ERTC unlocks an opportunity for business owners to claim credit that is rightfully deserved. However, reading the fine print of the requirements to correctly claim this credit reveals a complexity that is quite confusing.

What happens if a business has also received a PPP loan?

What if a business is eligible for R&D tax credits?

And what for a business that is eligible for R&D tax credits, has received a PPP loan that is later forgiven, and is also eligible for ERTC?

ERTC and PPP:

The Payroll Protection Plan (PPP) under the CARES Act, offered forgivable loans to small business owners to combat the challenges posed by the pandemic. Both PPP and ERTC acted as financial assistance to the businesses in this period of hardship, the similarity ends there.

PPP is essentially a loan up to 2.5 times the average monthly payroll costs. It could be used to cover rent, utilities, and some other qualifying expenses. On the other hand, ERTC is a tax credit, also extended under CARES Act, to encourage businesses to retain their employees. A lot of confusion persists about whether both can coexist for a single business.

The Consolidated Appropriations Act of 2021 solves this mystery. The truth is that businesses can avail of PPP and claim ERTC, under certain conditions. The business that receives both cannot double dip, utilizing both to cover the same wages.

There are ways to optimally utilize both PPP and ERTC to maximize the ERTC benefit. These include:

- Detailing calculations of qualified wages

- Bifurcating payroll costs

- Including costs not eligible for ERTC to avail of PPP

ERTC and R&D Tax Credit:

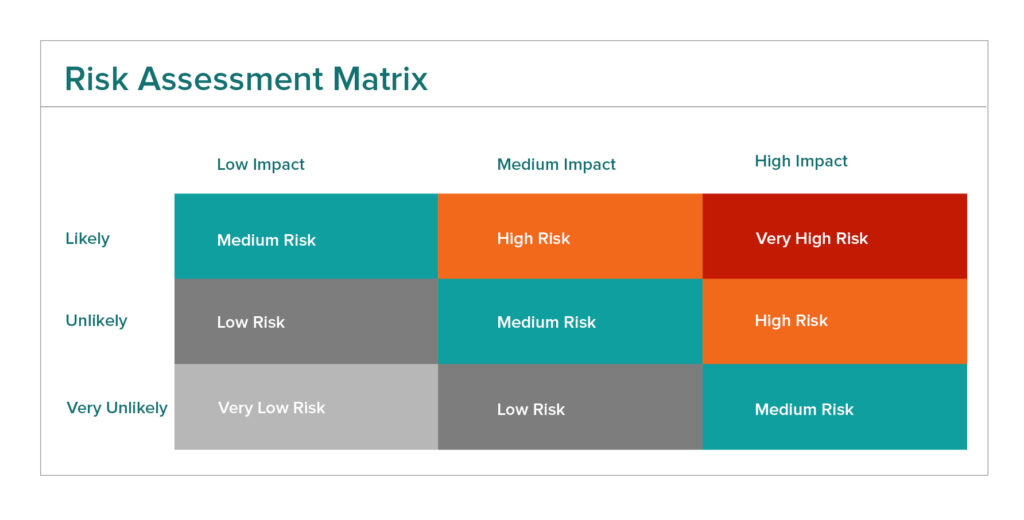

As ERTC and R&D tax credits cross paths to stake claims on eligible wages, it is necessary to take a deep dive into the bevy of rules surrounding both these concepts.

The Consolidated Appropriation Act, 2021 (CAA) has addressed this interplay for businesses that are intending to claim the benefits for both. The parameters include:

- Wages considered for claiming ERTC may not be considered in determining R&D tax credit.

- ERTC is limited to $10,000 in qualified wages and health plan expenses for the first two quarters of 2021.

- For the last two quarters of 2021, the CAA increased ERTC’s threshold of “large employer” from 100 to 500 employees.

While the R&D tax credit has its basis in the wages being a qualified research expense, ERTC has certain limitations of threshold and specific eligibility. As such it becomes very imperative for the taxpayer to analyze the qualified wages considering the stringent rules and legislations pertaining to both these benefits and optimize the claims.

If your business has qualified research expenses eligible for R&D tax credits intending to avail PPP forgiveness and claim ERTC, you are walking a tightrope.

This circumstance creates a very complex puzzle best solved by consulting experts and specialists in the field of ERTC and R&D tax credits. They can use their expertise to ensure that your business mitigates the risk of double dipping while optimizing your claim by appropriating the expenses in the most profitable way by legitimate means.

The Astute team has the requisite knowledge and expertise in the interplay between ERTC, PPP, and R&D Tax Credits.

Contact Astute to ensure optimum eligible credits and navigate through complexities pertaining to it.