Have you missed the boat on the ERTC? Or can you still get the benefit by filing claims?

Apparently, it is not too late. In fact, the ERTC is the only benefit that can be claimed retroactively until 2024. Along with EIDL and PPP as financial assistance packages provided, the ERTC was one of the benefits provided under the Coronavirus Aid, Relief and Economic Security Act.

However, the ERTC is the only benefit that can be availed for eligible businesses in 2023, and this will continue through 2024. Introduced in March 2020, the ERTC was a sunset provision with aid expiring in September 2021, and for certain businesses in December 2021.

Nonetheless, the IRS Notice 2021-49 clarifications issued provided a beacon of light that stated that ERTC benefits can be claimed retroactively till 2024. Businesses have three years after the program ends to look back at wages paid from March 12, 2020 to October 1, 2021, to determine eligibility and claim this benefit by filing through payroll taxes.

This gift of time can prove to be a new lease of life for small eligible business owners who may have previously missed this opportunity and can now claim or revise their form to claim the benefit.

How do you apply?

The only way to claim the ERTC now is by filing payroll taxes retroactively and amending the relevant tax forms. This requires diligence and utmost professional care to ascertain eligibility and maximize the benefit.

What is the eligibility criteria?

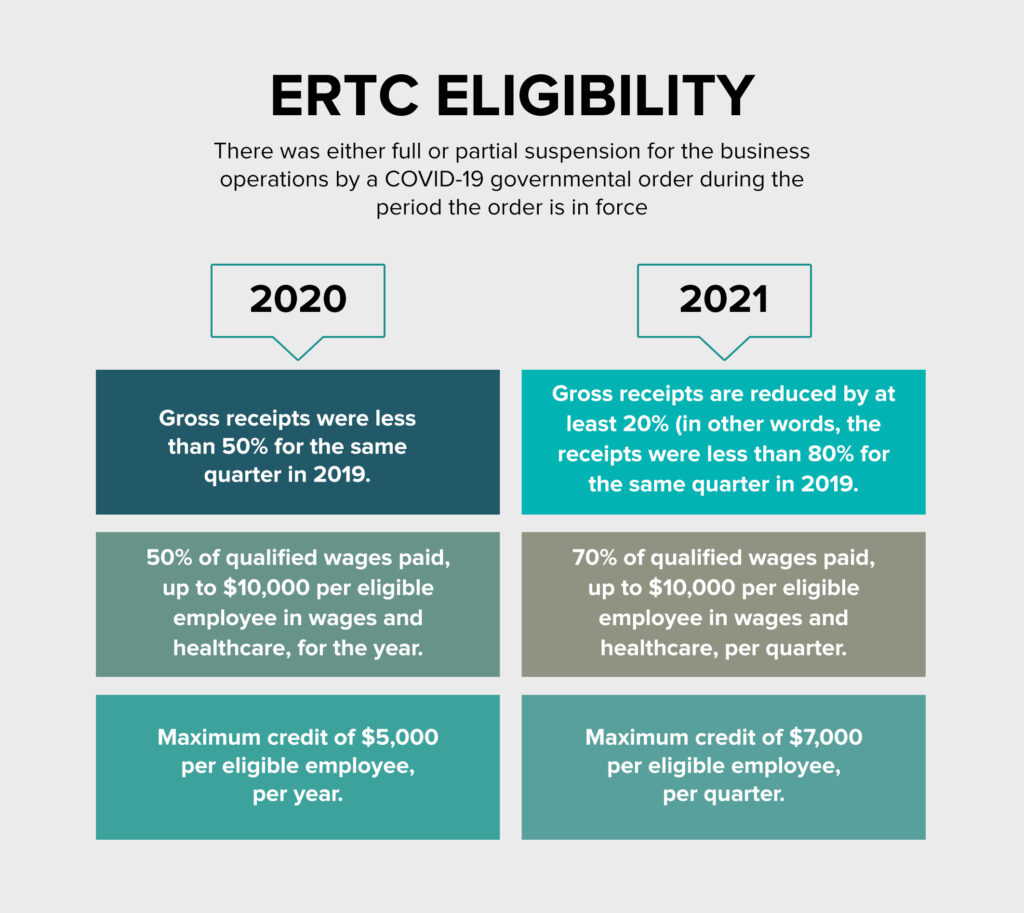

Eligibility criteria is slightly different for 2020 and 2021.

The two most critical factors to determine eligibility are:

- That a business had been fully or partially suspended or compelled to reduce business hours due to the Government order.

- That an employer has had a significant decline in gross receipts.

There are certain eligibility criteria that may help fetch credit despite unaffected revenue like supply chain disruptions or certain, limited capacity to operate etc.

To unlock the possibility of availing this benefit, Contact Us.

Starting a business at the outset of the pandemic or amidst Covid- 19, was a herculean task.

What is the relief provided to start-ups then?

Can ERTC and PPP coexist? To know more about these finer but critical issues, stay tuned for our upcoming blogs.