Most business teams – in nearly every sector – are still working remotely, including their accounting and finance departments. Thus, those in the accounting and financial departments should collaborate often to identify potential risks. So how can you be certain that you have limited yet correct access to the data to make the critical financial decisions and minimize the risk of misappropriation or fraud?

An outsourced accounting team with expertise in conducting Internal Audits, along with a full range of CFO advisory services – at fractional costs – is the perfect solution for small to mid-sized businesses. In addition to huge cost-saving benefits, outsourcing also simplifies workflow and saves time. When companies outsource financial tasks, they have more time to dedicate to improving business performance and invest back into the business with increased cash flow.

By outsourcing CFO services, you will have the peace of mind in knowing your processes and controls are fortified and protected. Additionally, a highly proficient team of financial experts can perform risk assessments, improve processes by identifying gaps, perform internal audits and implementing the necessary controls to mitigate any risk of asset misappropriation and fraud. Again – the added bonus: these services are not cost-prohibitive. The cost that would be allocated to a full time CFO can be invested into the company.

You don’t need to perform a complete overhaul. You can start by conducting a risk assessment to pinpoint any vulnerability.

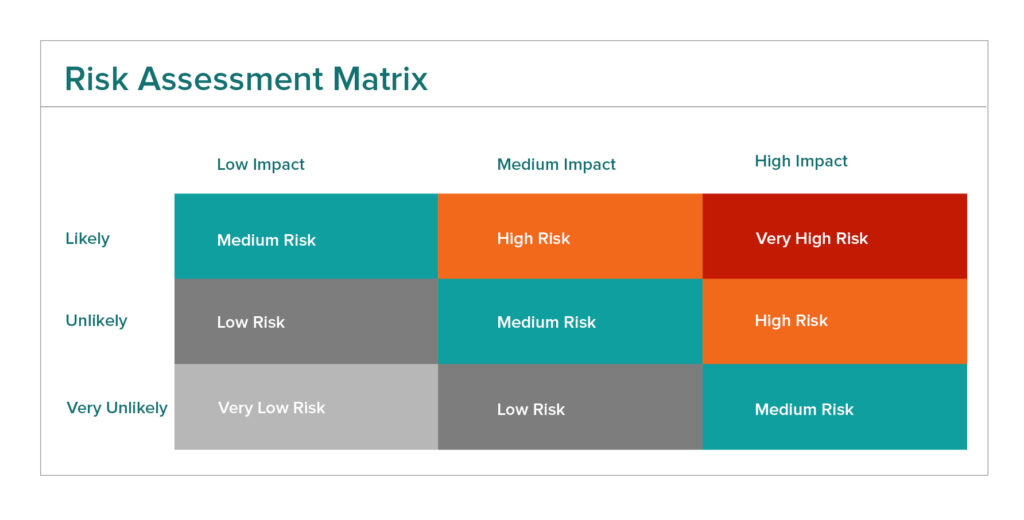

A great visual tool is a simple matrix that helps categorize low, medium and high impact risks, along with the probability of their occurrence: likely, unlikely, highly unlikely.

Based on the nature of a business, an organization must revisit delegation of tasks and authority, use technology to set controls, and actively communicate the changes with their team. For example, some operations that require employees to be at a physical location to operate may be compromised when working remotely, such as inventory cycle counts. In a situation like this, the Controller must consider the impact on affected transactions, and bring in compensating controls that can be designed to alleviate some of the control risk.

Role-based access – Delegation of authority

Segregation of duties and a clear line of authority to carry out tasks in a remote workplace is a critical step. Team leaders can assign access to employees based on their roles, and use technology to carry out operational tasks that were previously done in person. These internal controls must be established at the top and effectively communicated through the organization.

Define workflows – A cycle for approvals

Setting up workflows for reviews and approvals within the organization can enhance collaboration and prevent override of controls. Use of online billing and payroll applications can assist in timely approvals and running business operations in remote teams. This will especially hold true for companies who are transitioning from paper to a digital environment.

Adapt Digital Payment Methods

Since digital transactions cannot be avoided in a remote workplace, documenting every step of the process can prevent errors. Team leaders must verify, at every step, that the control has been executed correctly and a log is maintained. A timely identification of error can help avoid consequences for later.

Now that most of the workplace has pivoted to working from home, many companies have stated they will adapt a hybrid model for the future; studies show that employees are just as productive in a virtual environment.

According to Global Workplace Analytics, U.S remote work soared 173% between 2005 and 2018. Researchers tell us that the trend isn’t going to reverse once the lockdown ends. Much of the credit for allowing this seamless transition goes to innovative technology; it has the capacity to allow businesses to streamline their financial processes, controls, and the segregation of duties to carry on as usual – even in remote environments.

Astute has been helping many businesses across the U.S. who have been drastically impacted by the pandemic and subsequent lockdowns. Our team of professionals continues to assist clients navigate through these uncertain times. We take proactive steps to identify potential risks so you can address them promptly.

We have been thrilled to see that although 2020 was a stressful year, many of our clients are overcoming adversity; they remain optimistic about the future. The resilience we see motivates us to continue to strive diligently to create value for all our clients. Contact us today and discover how we can help you up your game and continue making strides in growing your business – while helping you protect your controls. Companies that take the necessary steps to fortify their internal controls are ones that will persevere and become more resilient for the next disruptive force.