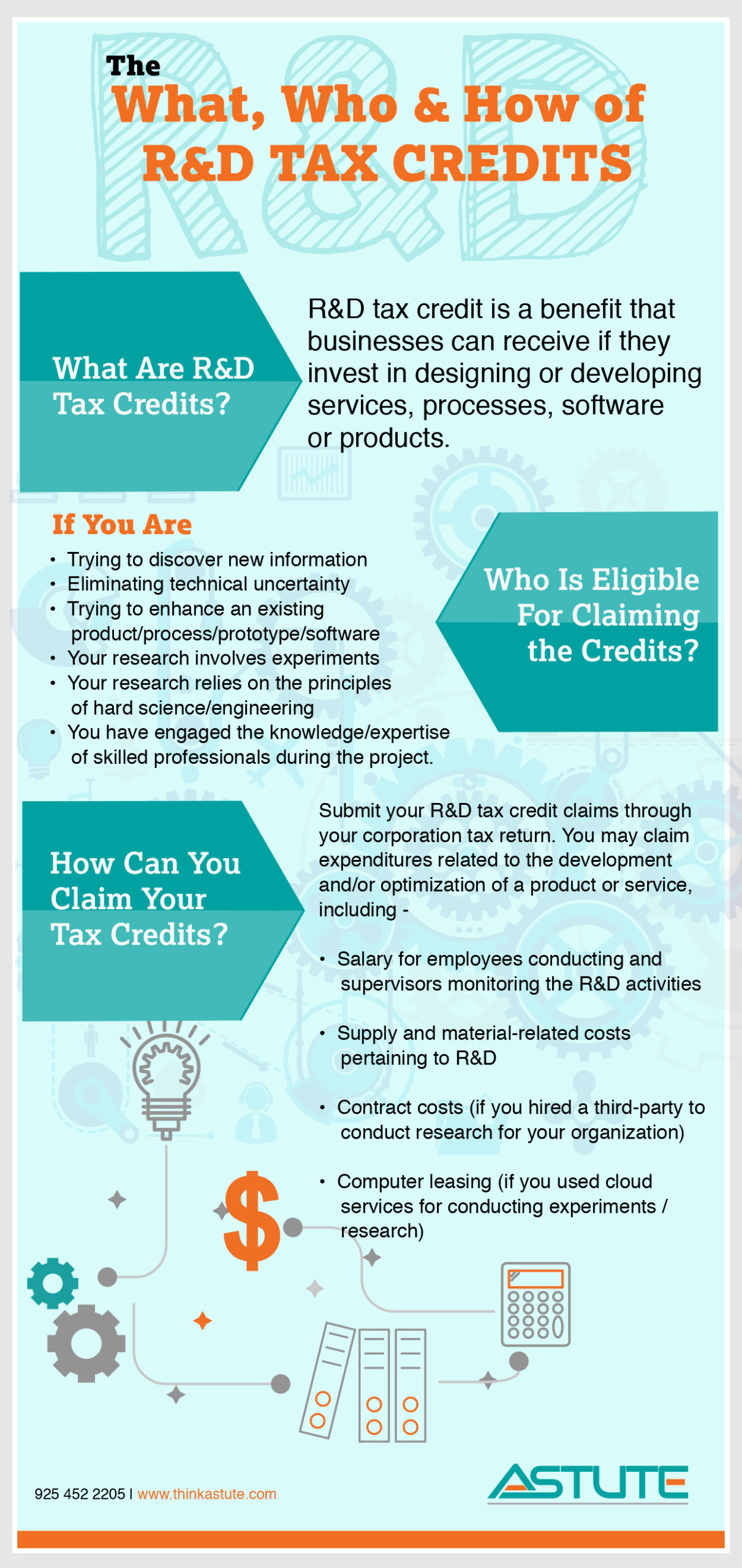

Mention the words “tax break” in any business setting, and heads turn. If there’s a way to save a company money, people want details. But when you hear it’s an R&D tax credit—and you’re a manufacturing firm—it may not sound like headline breaking news. You may have always assumed that other industries, such as big pharma and technology, have the corner of the market. So you tune it out.

We want to dismiss these misconceptions; manufacturers are actually optimal candidates for the R&D tax credit. Inherent to their industry, they continuously strive to improve their processes and products.

Take a look at the cold, hard facts: the manufacturing industry captures over $7.4B in R&D tax credits annually! Innovation is the driving force behind the manufacturing industry, and the government is proceeding full steam ahead to encourage expansion and growth.

This insufficient knowledge and rampant spread of misinformation is costing manufacturing companies a fortune. The R&D experts at Astute have been successfully helping manufacturing companies take advantage of these tax savings. We are on a mission to continue to spread the good news to small and mid-size companies that they may receive federal credits, just like the major power players do.

The manufacturing industry has a vast assortment of work products and processes under its umbrella, ranging from iron casting to injection molding. And to stay in business, they must innovate. Some examples of eligible innovations within the manufacturing industry include:

- Innovating product development using computer-aided design tools

- Developing second-generation or improved products

- Prototyping and three-dimensional solid modelling

- Streamlining manufacturing processes through automation

- Increasing ease of operation or suitability of manufactured products

- Tooling and equipment fixture design and development

- Designing innovative manufacturing equipment

- Prototyping and three-dimensional solid modeling

The fourth industrial revolution, Industry 4.0, is picking up steam. In an ongoing cycle, rapid advancements are empowering the revolution and setting the stage for even more transformational innovation. Characterized by the further development of autonomous technology based on the power of data and machine learning, the manufacturing industry is at the center of Industry 4.0. Over the next decade, innovation will profoundly shift the landscape with an even greater speed and efficiency, allowing for increased ability for manufacturing firms to receive the tax credit and other incentives.

Since the R&D tax credit became a permanent law, companies have been able to breathe more easily, as there is no longer any anxiety about “what if” scenarios. Now, companies have clarity and a long runway ahead. Here are a few of the benefits of the tax credit:

- This isn’t just a one-year wonder; companies can continue to claim the tax credit annually. By figuring out the process now, you can set yourself up for future success.

- The tax credit is good against the alternative minimum tax (AMT), so companies are now able to reduce their tax liability below their AMT.

- Start-ups are also eligible to claim the tax credit.

- The expansion of the law makes it easier for small and mid-size companies to recover and/or reduce their tax liability through the R&D tax credit.

Manufacturing businesses will need to engage an accounting firm that can sift through their expenses to identify which ones qualify. This will ensure you make maximum use of the tax credit.

The Astute team is expert in analyzing supply costs, processes, and more to determine if you are a good candidate for receiving the R&D tax credit.

If you’ve been racing against the clock, then no doubt you were relieved when the IRS announced they are giving taxpayers more time to file their 2020 U.S. Individual Income Tax Returns. With this extension, many S Corp and LLC businesses are taking advantage of this extra time to get their documents and data in order.

Unless you are an expert, the fine print in the R&D tax credit law may seem like Greek – but not to the professionals at Astute. To lay claim to your fair share, it’s highly recommended that you contact experts such as Astute. That way, you will have the assurance that the right team understands all your activities, expenses, and finances and can accurately determine what amount you may be missing out on.

To give you an estimate of the total savings you may reap, we have developed an R&D tax credit calculator for your convenience.