When a SME owner tries to double up as both the CEO and CFO, there’s a high likelihood he/she will spread themself too thin and make hasty financial decisions with half-baked information pertaining to investments, cash flow and accounting processes.

However, hiring an in-house CFO may not be a viable option always because of the high salaries. Did you know, according to Salary.com, the median yearly salary for a CFO in 2019 was a whopping $371,548? This amount doesn’t even factor in additional payments, including health coverage, income tax, insurance, bonuses etc. What could be the best way forward, then? Consider partnering with an ‘Outsourcing CFO’. Let’s take a closer look.

Who Is an Outsourced/Fractional CFO?

Having a CFO is especially important for organizations in their growth stage – every business needs a financial leader who can establish best practices for accounting, provide financial visibility, and offer data-driven insights for financial and strategic growth planning. An outsourced CFO, also referred to as a fractional CFO, is an experienced professional that brings in the expertise and insights needed to perform the role. He offers services to multiple organizations on a contract, retainer, or part-time basis. This enables a business to enjoy the expertise and experience of a CFO without the overwhelming salary + overhead costs of maintaining an in-house, full-time executive-level employee. And, because outsourced CFOs bring years of diverse experience to the table, they can hit the ground running immediately – the onboarding process is very quick and stress-free.

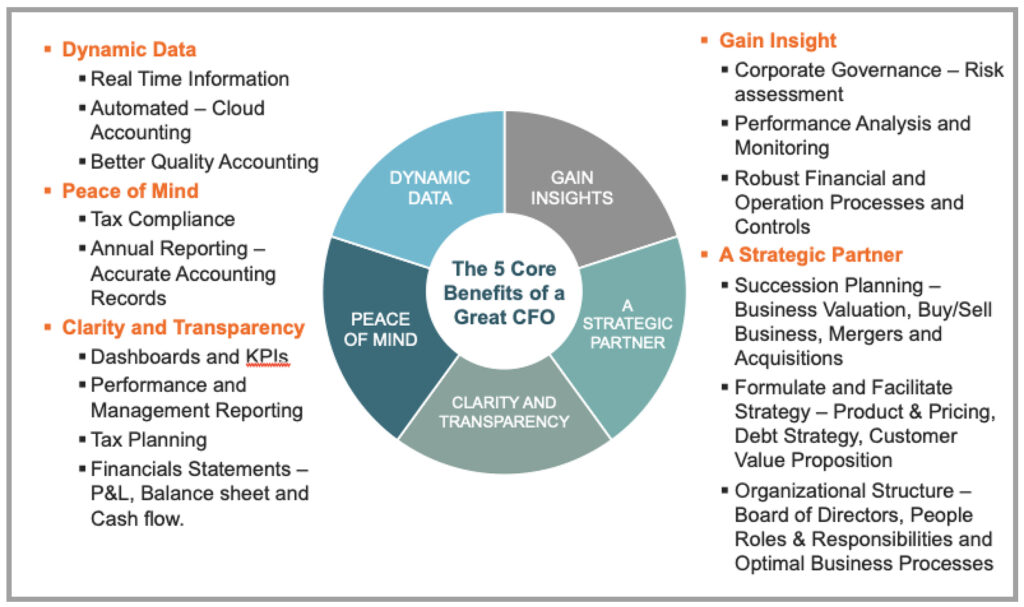

How Can An Outsourced CFO Offers Value?

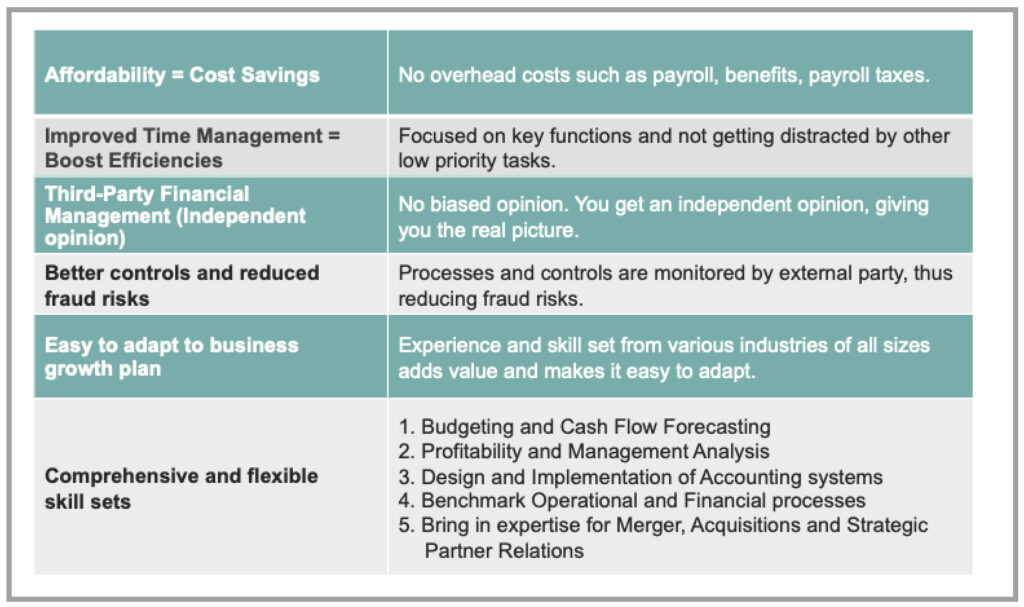

A CEO can use a fractional CFO to their company’s advantage in a multitude of ways. An outsourced CFO will provide a CEO with an unbiased opinion surrounding their business’ finances so they can lead their company toward steady growth. Furthermore, having an outsourced CFO helps CEOs become better leaders – they can manage their own time efficiently by focusing on key functions rather than looking into low-priority tasks. In addition, with healthy processes and controls in place, fraud risk is reduced.

Benefits From Fractional or Part-time CFO/Controller

The Way Forward : Outsourcing CFO Services Enables CEOs To Perform Better

In essence, outsourcing your CFO services allows you to gain excellent financial advice at a substantially lower cost – from analyzing profits, expenses and roadblocks to setting long-term and short-term strategies to creating business plans and forecasts to raising capital an SME can benefit immensely from a helping hand, especially if he is in restructuring or growth stage.

An outsourced CFO can be viewed as an extension of your team that opens up room for you as a business owner to focus on your role with more energy and clarity. You can manage your time effectively without unnecessary distractions! In addition to that, harnessing accurate, unbiased information and meaningful insight will empower you to target your energy on strategic and managerial aspects so your company continues to grow steadily.

Astute has helped many businesses grow through a vast array of CFO services we provide, which are rooted in years of accounting expertise. We take time to understand your vision for your business and then ensure your financial strategies, plans, processes, and actions are in sync. We consider ourselves an extension of your company that will help you make better decisions faster so you can become more profitable. From complex accounting tasks like revenue recognition and report generation to evolving your finance and accounting systems in real-time and everything else in between, we have your back ‘round the clock through thick and thin.

For more information, contact us.