1. Chief Financial Officer (“CFO”) – What is the role of a CFO in an organization?

A Chief Financial Officer (CFO) is primarily responsible for properly managing the company’s finances and advising the CEO on strategic growth decisions. This includes an analytical and strategic review of the company’s financial strengths and weaknesses, financial planning, financial reporting, and management of financial risks. A CFO can also contribute to the formation of business strategies to ensure that the plans and actions are in accordance with the goals. A CFO can help an organization make significant decisions, including buying and selling transactions, succession issues, corporate governance, capital generation, and debt clearance. To summarize, a CFO is a value-added partner to the CEO who charts a vision and a growth path that is sustainable for the business.

2. What is the difference between a CPA and a CFO?

The terms CPA and CFO are interchangeable. A certified public accountant (CPA) is a designation given by the American Institute of Certified Public Accountants (AICPA) to individuals that pass the Uniform CPA Examination and meet the education and experience requirements. The CPA designation helps to enforce professional standards in the accounting industry.

Individuals with the CPA designation can also move into executive positions such as Controllers or Chief Financial Officers (CFOs). CPAs are known for their role in income tax preparation and can specialize in many other areas, such as auditing, bookkeeping, forensic accounting, and managerial accounting. A CPA can provide a wide range of services from filing Income Tax Returns to providing Audit (Internal and External), Assurance, and Forensic Accounting. The role of a CFO is explained in question #1. An important thing to remember – A CFO may or may not be a licensed CPA.

3. What is the difference between a fractional CFO and a part-time CFO?

The key difference between a fractional CFO and a part-time CFO is that a fractional CFO has a project-based approach (i.e. he manages a clearly defined set of responsibilities and not looks after the complete role), whereas a part-time CFO looks after a wider gamut of responsibilities, but only on a part-time basis.

A part-time CFO is a professional with years of experience who may or may not be a CPA and works closely with the business to help them become profitable. His key purpose is to assess a company’s financial risks, to look for new opportunities, and to oversee the staff that is part of the financial department.

A fractional CFO offers much more specialized services. For e.g. He ensures accounting and ERP systems are set up correctly to give correct financial data for critical decision making, assists the CEO to build a strategy for business growth, analyzes and interprets financial data to strategically position, and establishes a benchmark in the industry. Additionally, he plans reinvestment of profits for sustainable growth and looks into succession planning and/or exit strategies.

4. What is the difference between a CFO and a Controller?

A strong accounting team should consist of senior-level executives who can oversee the accounting and tax compliance functions, and at the same time provide financial insights for operational success and growth. Usually, these functions are not performed by one individual but are split between a Controller and a CFO. A Controller role is a supporting role to a CFO in an organization.

A Controller is typically responsible for overseeing the accounting department, and tax compliance-related tasks. His primary job is to manage the financial records, maintain the accuracy and precision of business processes, and ensure a controlled environment to mitigate risks within the business. A Chief Financial Officer (CFO), on the other hand, is responsible for formulating the financial growth path. CFO works closely with the CEO to outline financial strategies, risk management strategies, and drive investor relationships.

For a small business, a Controller can show where things are with clarity and accuracy, and a CFO can bring in a forward view for the company.

5. How can a company decide when is it the right time to hire a CFO/Outsourced CFO?

Every business needs a financial leader at some point in their unique journey. When you should hire a CFO depends entirely on your business, its growth rate, and the industry your business belongs in.

If you are experiencing rapid growth (and are finding it hard to cope with this sudden change in pace), or are spending too much time dealing with financial issues (the time you could be spending more effectively working on the things you are best at), or are in need of expert advice about product pricing, forecasting, budgeting and expediting growth, it might be an indication to hire a CFO (in-house or outsourced/fractional/part-time). Companies that are more than $20 million in revenue could consider hiring a CFO/Controller or take services of an Outsourced CFO, depending on how tactical or transactional the business is. But as a rule of thumb, every business should have a Financial Leader to support the CEO.

6. Why is having a full-time CFO more expensive than having a Fractional/Outsourced CFO?

The average cost of hiring a full-time CFO can easily run into 6-digit figures, even higher 6-digit figures when you calculate overhead costs (payroll, benefits, payroll taxes).

A fractional/outsourced CFO is focused on a project or a key function. They operate as an independent/unbiased Finance Leader. They do not have to be full-time employees incurring wages and other overhead expenditures. You can gain years of financial experience and access to an entire team that brings combined knowledge expertise at a much more affordable cost by working with a fractional/part-time CFO. An additional benefit is that you can mitigate and reduce fraud risk since an external, independent party monitors and oversees business processes and controls.

7. What value can a CFO bring to a CEO?

A CFO brings a value-added partnership that allows the CEO to make critical decisions based on financial data. Some of the many areas a CFO is responsible for include – monthly financial reporting, presenting financial statements to the Management, budgeting and cash flow forecasting, projection and financial analysis, design and implementation of best accounting practices to mitigate enterprise-level risks, fraud risks, tax, and cash management planning and strategy. A CFO acts as a strategic finance leader during mergers, acquisitions, and strategic partnerships. With clarity, transparency, meaningful insight, and data in place, you, as a business owner, are bound to gain more peace of mind so you can focus on what you do best.

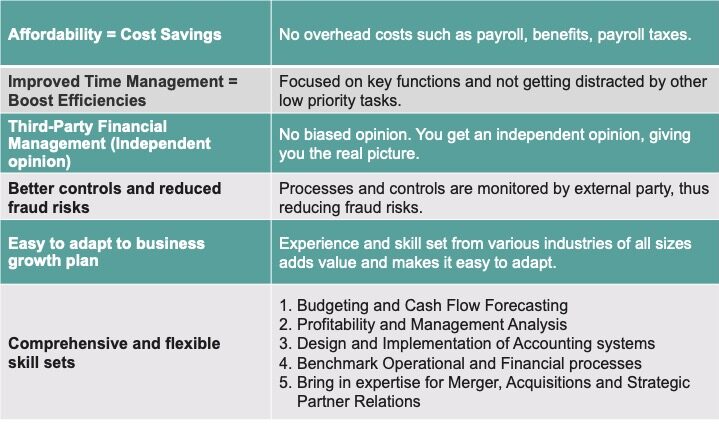

8. What are the benefits of an Outsourced/Fractional CFO?

© Copyright 2020 All rights reserved. Astute

© Copyright 2020 All rights reserved. Astute

Astute has helped many businesses grow through a range of CFO services. We are a value-add certified accounting and business advisory firm that has years of experience in enabling companies to maintain compliance, recover lost revenues, and boost profitability. For more information on our Outsourced / Fractional CFO services, contact us right here.